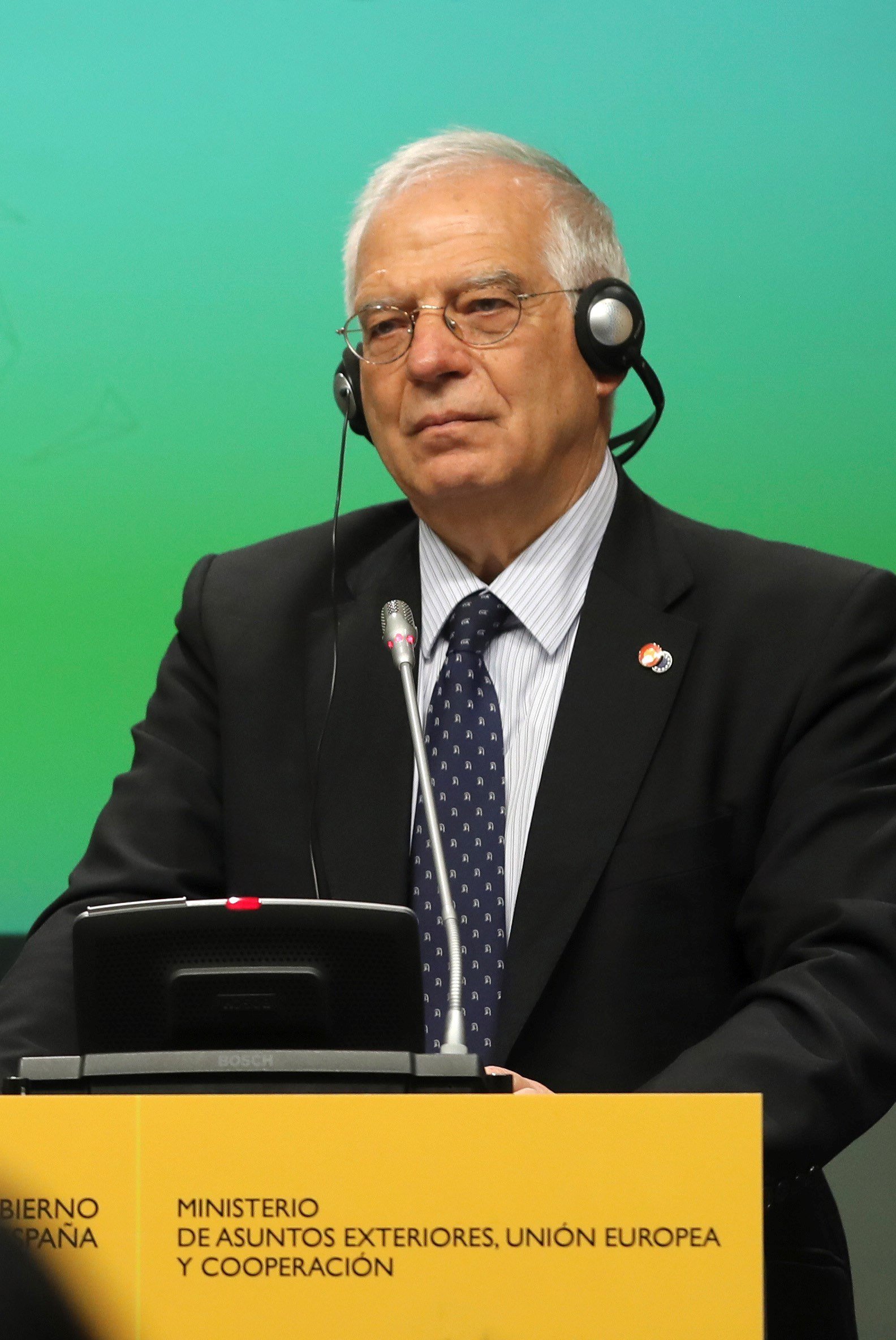

Spain's National Stock Market Commission (CNMV) has fined foreign minister Josep Borrell 30,000€ (£26,600; $33,900) for the fraudulent sale of Abengoa shares.

As published today in the Official State Gazette (BOE), the sanction is for a "very serious infraction" consisting of the sale of 10,000 Abengoa shares "on behalf of a third party" for a value of 9,030 euros "while possessing privileged information". The transaction was made on 24th November 2015.

"Inappropriate" sale

In October, Borrell himself admitted that the sale "was not appropriate" for the moment when it happened and for the "appearance of irregularity" it could create. He said, however, that it was a "problem of little value" which doesn't affect his "suitability to carry out his ministerial duties".

"It is illogical that, if someone had the information attributed to me, they would limit themselves to selling only 8% of their portfolio", said Borrell, who counted out appealing the sanction because, in his opinion, to do so "would not be politically correct", given that it could create a conflict of interests with the economy ministry.

6.3 billion in debt

At the end of November 2015, Abengoa, with net debt of 6.3 billion euros and brute debt of 8.9 billion, took a preliminary step towards insolvency proceedings and managed to avoid bankruptcy by agreeing with creditors to restructure the group and inject 1.17 billion euros in exchange for ceding 90% of its capital to funds, banks and bondholders.

Borrell testified in October 2017 at the trial against the former senior leadership of Abengoa over the firing bonuses for the companies former president, Felipe Benjumea, and its former CEO, Manuel Sánchez Ortega.

He testified only as a member of the nominations and retributions commission. He said that he hadn't been present at the meeting which approved the payments.